Introduction

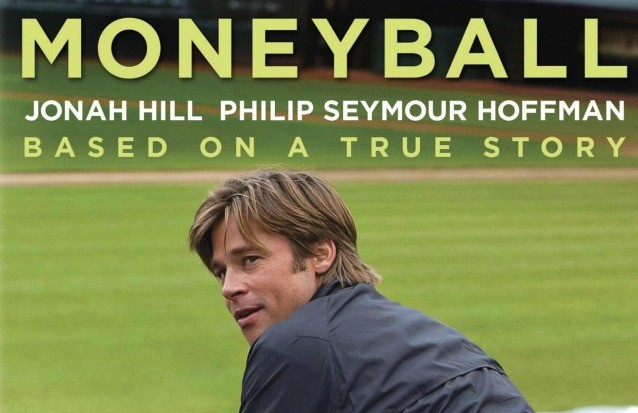

The 2011 film Moneyball, based on a true story, revolutionized the way we think about decision-making. By embracing a data-driven approach, the Oakland Athletics challenged traditional baseball strategies, achieving extraordinary results on a limited budget. But what can Moneyball teach us about personal and business finance?

In this blog, we’ll uncover how the principles of data-driven decision-making from Moneyball can transform the way you manage money, make investments, and achieve financial goals.

1. The Power of Data in Financial Planning

Just as the Oakland Athletics used player statistics to make smart choices, you can leverage data to optimize your financial decisions. Financial tools, apps, and analytics make it easier than ever to track your spending, savings, and investments.

Actionable steps:

- Use budgeting apps like Mint or ET Money to track expenses and identify trends.

- Analyze your financial habits to find areas for improvement.

- Plan savings and investments based on data, not emotion.

Lesson from Moneyball: Rely on objective data, not intuition, to guide your financial decisions.

2. Making the Most of Limited Resources

Billy Beane’s team worked within a tight budget, proving that constraints can inspire innovative strategies. Similarly, financial success often comes from maximizing the resources you already have.

Tips for managing limited finances:

- Focus on high-impact investments, such as skill development or diversified portfolios.

- Prioritize needs over wants when budgeting.

- Explore tools like Credit Consultancy for loan comparisons or financial planning services.

Key takeaway: Resourcefulness and smart allocation can outshine sheer financial power.

3. Challenging Traditional Financial Norms

Moneyball is a story about breaking away from conventional wisdom. Whether it’s rethinking how you save or how you invest, questioning traditional financial practices can yield better results.

Examples:

- Instead of following the crowd, research new investment options like ETFs or REITs.

- Reevaluate debt management strategies, such as consolidating loans for lower interest rates.

- Leverage technology, like robo-advisors, for personalized financial advice.

4. Importance of Consistent Monitoring

Throughout the season, the Athletics constantly evaluated and adjusted their strategies. Similarly, regular financial check-ins can ensure you’re on track to meet your goals.

Steps to stay on track:

- Set monthly reminders to review your budget and investments.

- Use online financial dashboards to monitor net worth and liabilities.

- Adjust savings or debt payments as your financial situation evolves.

Financial lesson: Continuous monitoring leads to informed adjustments, maximizing returns.

5. Leveraging Metrics for Investment Decisions

In Moneyball, the team focused on overlooked metrics that truly mattered. When it comes to investing, focusing on key financial indicators like ROI, expense ratios, and risk levels can help you make better choices.

What to consider before investing:

- Research funds or stocks with strong long-term performance.

- Diversify your portfolio to reduce risk.

- Use platforms like Zerodha or Groww for detailed investment analysis.

Conclusion

Moneyball proves that data-driven decisions can outperform intuition and tradition—not just in baseball, but in the financial arena. By applying these principles to your personal or business finances, you can maximize resources, challenge norms, and achieve your financial goals.

To take your financial game to the next level, explore services at Credit Consultancy for expert advice on loans, investments, and planning.